Scammers have reached a whole new level of sophistication, preying on unsuspecting victims with deceptive websites that look eerily legitimate. The digital age offers convenience but also opens doors for crafty cybercriminals. This is the story of Paul from Massachusetts, a cautionary tale of how a simple online search turned into a nightmare.

A Quick Search That Cost Paul Big

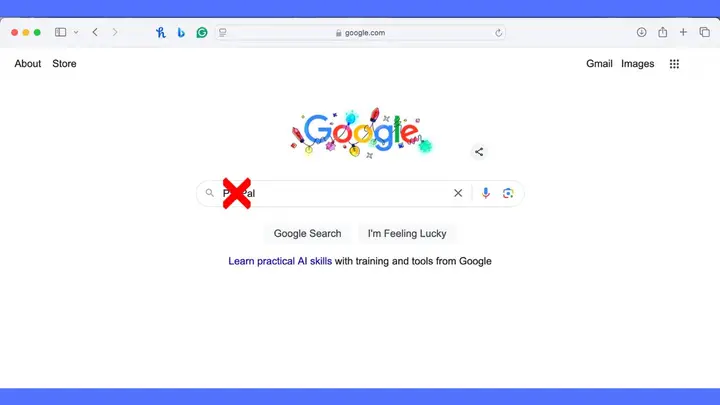

Paul recently shared his shocking experience with CyberGuy Report. It all started when he used Google to sign up for PayPal. Innocent enough, right? But in his words:

“I wanted to sign up for PayPal and used Google to get the website. After the ‘website’ popped up, it asked me for the usual name, address, etc., and my credit card number with the expiration and 3-digit code. Almost immediately, I received a flash message from my credit card company asking if I made a purchase at a company in OKLA. I live in MA and had the card in my lap. The information was stolen, and a purchase was made almost immediately.”

The rapid chain of events didn’t stop there. Paul’s credit card company quickly identified the fraud, contacted the fake merchant (who conveniently had a fake phone number), and closed his account to block further transactions. Within just 10 minutes, the thieves had already attempted a second purchase.

The Alarming Reality of Online Fraud

Paul’s experience offers some chilling insights into how cyber scams unfold:

- Fake Websites Look Real

Scammers craft sites so convincing they can easily fool anyone. These fake platforms often mimic well-known brands, complete with logos and professional layouts. - Speed of Fraudulent Transactions

Once scammers obtain sensitive data, they act fast. Paul’s credit card was compromised within minutes. - Quick Action from Credit Card Companies

Financial institutions have robust systems to detect unusual activity. In Paul’s case, their swift response prevented more damage. - The Need for Vigilance

A moment of distraction or misplaced trust can lead to significant losses. Online safety requires constant awareness.

How to Protect Yourself from Scams

Online financial scams are preventable if you know the right steps. Here’s how you can protect yourself:

Verify Website Authenticity

- Check URLs carefully. Look for “https://” and a padlock icon in the address bar.

- Type the address manually. Avoid relying on search results or links from emails.

Stay Alert for Phishing Attempts

- Be cautious with unsolicited emails or messages asking for personal information.

- Hover over links to verify where they lead before clicking.

Use Strong Security Measures

- Enable two-factor authentication on all financial accounts.

- Create unique, strong passwords for every account. Consider using a password manager.

Regularly Monitor Accounts

- Frequently check for unauthorized transactions.

- Set up alerts for activities on credit cards and online payment platforms.

Prioritize Secure Payments

- Use credit cards for online purchases, as they offer better fraud protection.

- Opt for platforms with buyer protection when dealing with unknown sellers.

Avoid Public Wi-Fi for Transactions

- Public Wi-Fi is a playground for hackers. Use a VPN if you must access financial accounts on-the-go.

What to Do If You’ve Been Scammed

If you suspect fraud, take action immediately:

- Change Your Passwords

Secure all accounts that might be compromised. - Contact the Company

Report suspicious activity to the affected platform. - Alert Your Bank

Notify your credit card company or bank to block further unauthorized access. - Use Identity Theft Protection Services

These services can monitor your personal information and alert you if it’s misused. - Report the Incident

Forward scam emails to authorities and delete them from your inbox. - Keep an Eye on Credit Reports

Monitor for unauthorized activities or new accounts opened in your name.

Final Thoughts: Stay Vigilant, Stay Safe

Paul’s story is a stark reminder of how quickly things can go south when online safety is overlooked. By taking extra precautions—like verifying websites and using secure payment methods—you can reduce the risk of falling victim to these scams.

Your financial security is worth the effort. Take time to double-check before sharing sensitive information. Remember, when it comes to cyber safety, it’s better to be overly cautious than regretful later.

Stay safe online! If you’ve had a similar experience or want to share tips, drop a comment below. And don’t forget to sign up for newsletters like The CyberGuy Report to stay informed.