This has been another blockbuster year for the stock market, and once again, Amazon (NASDAQ: AMZN) has proven itself as a leader. The stock has surged roughly 48% year-to-date and boasts an incredible 150% gain over the past five years. Yet, even with this meteoric rise, Amazon remains a solid choice for investors in this bull market. Here are four compelling reasons you should consider buying Amazon stock like there’s no tomorrow.

1. Dominance in Cloud Computing

Amazon may be synonymous with e-commerce, but its most lucrative business segment is Amazon Web Services (AWS). Over the past 12 months, AWS generated $36.4 billion in operating income, dwarfing the North American and international e-commerce operations at $22.2 billion and $2.1 billion, respectively.

With a commanding 31% market share in cloud computing, AWS outpaces Microsoft’s Azure (20%) and Google Cloud (12%). The rise of artificial intelligence (AI) has accelerated this growth. Last quarter alone, AWS’s revenue jumped 19% year-over-year, and its income surged an astonishing 49%. Amazon’s management refers to generative AI as a “once-in-a-lifetime type of opportunity,” underlined by triple-digit percentage growth in AI-related revenue at AWS.

AWS’s AI strategy is multi-faceted:

- SageMaker Platform: Helping businesses build, manage, and deploy AI models.

- Bedrock Platform: Offering foundational AI models, including those from Meta Platforms, Anthropic, and Mistral.

- Custom AI Chips: Designed to train large language models (LLMs) and handle AI inference; even tech giant Apple is a customer.

Amazon is pulling out all the stops to ensure it remains at the forefront of this transformational tech wave.

2. The King of Online Retail

Even as AWS becomes Amazon’s crown jewel, e-commerce remains the backbone of the company. Gone are the days of hyper-growth, but the retail segment still thrives. North American revenue grew by 9% last quarter, while international revenue climbed 12%. Even more impressive is the improvement in profitability—operating income for the North American segment rose 33%, and the international segment returned to profitability.

Amazon is harnessing AI to enhance both cost efficiency and customer experience:

- Automation and AI in Warehousing: Streamlining operations and optimizing shipping routes.

- AI for Sellers and Shoppers: Simplifying product listings for third-party sellers, offering better recommendations, and addressing customer queries.

- Sponsored Ads: AI also improves the relevancy of ads, driving growth in Amazon’s ad business.

3. Winners Find a Way

Amazon’s ability to innovate and adapt is nothing short of legendary. From selling books online to becoming the world’s largest retailer and logistics company, Amazon consistently breaks barriers. AWS itself began as a side project, transforming into a $36 billion profit engine. History suggests Amazon will approach the AI opportunity with the same determination, ensuring its place as a market leader for years to come.

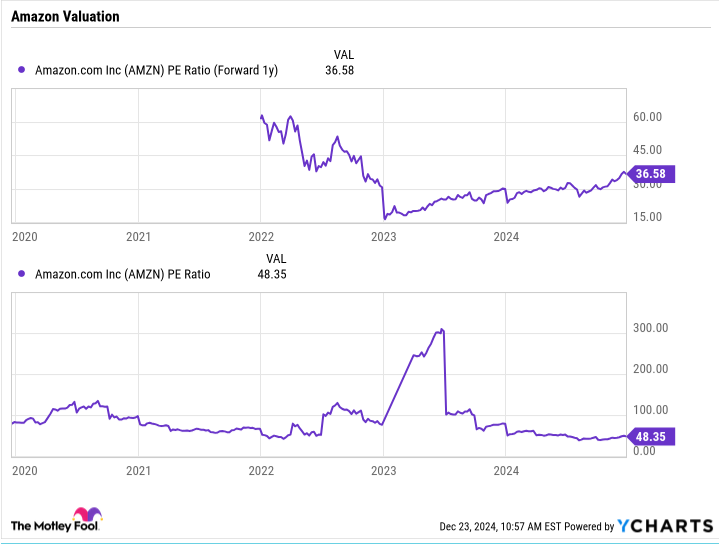

4. Valuation That Makes Sense

Despite its success, Amazon remains attractively valued. Its forward price-to-earnings (P/E) ratio of about 36.5—based on 2025 analyst estimates—is reasonable compared to historical levels. While Amazon often endures periods of heavy investment that impact earnings, these have historically led to stronger growth over time.

Amazon’s proven track record of innovation, its leadership in high-growth industries like cloud computing and AI, and its solid e-commerce backbone make it a compelling investment. Add in an attractive valuation, and it’s clear why this stock should be a cornerstone in any portfolio.