Bill Gates is back at it, making waves in the investment world. This time, the Microsoft co-founder and celebrated philanthropist is betting big on the transportation sector for 2025. Through the Bill & Melinda Gates Foundation Trust, Gates has plowed $373 million into two industry heavyweights: FedEx (FDX) and Paccar (PCAR).

But why now? And more importantly, should investors follow his lead?

Let’s break down what Gates might see in these two transportation giants—and whether the rest of us should share his optimism or proceed with caution.

The FedEx Play: Bold or Brilliant?

When Gates purchased 1 million shares of FedEx, it wasn’t just a nod to the company’s global shipping dominance. It was a bet on recovery, innovation, and, maybe, a little faith in a sector that hasn’t kept up with the broader market.

FedEx, headquartered in Memphis, Tennessee, is no small fish. It runs one of the world’s largest cargo airlines and an extensive ground delivery network. But here’s where things get interesting: while the broader S&P 500 Index ($SPX) soared 22% last year, the S&P 500 Transportation Index ($SYTR) eked out a modest 3.4% gain.

So, is Gates seeing an undervalued opportunity, or is this a risky move?

By the Numbers

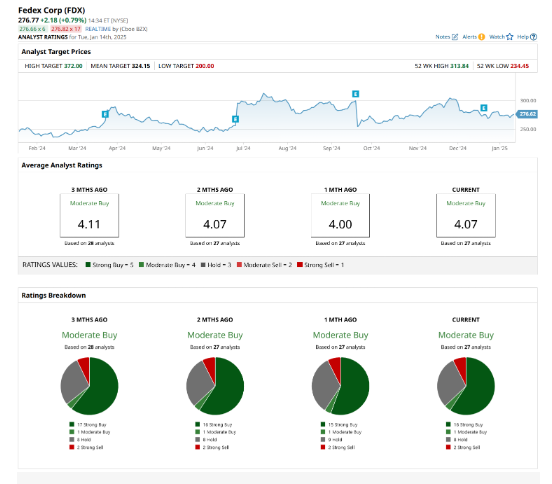

FedEx shares are trading near $277, with a reliable 2.01% annual dividend yield—a decent income play. Over the past 52 weeks, the stock has climbed 11%, even as its YTD performance dipped by 1.8%.

The company’s forward P/E of 14.22x signals a valuation below the industry average, suggesting it might be a bargain. But dig a little deeper, and the story gets more complex.

Revenue for Q2 FY2025 came in at $22.0 billion, slightly down from last year’s $22.2 billion. CEO Raj Subramaniam emphasized operational improvements, but challenges like weak U.S. domestic demand and the loss of its U.S. Postal Service contract linger.

And then there’s FedEx’s ambitious pivot:

- Freight Spin-Off: Plans to separate its Freight division into a standalone company within 18 months.

- Aggressive Buybacks: $1 billion in completed repurchases, with another $500 million planned.

- Cost Savings: The DRIVE transformation program aims for $2.2 billion in cuts.

Analysts seem cautiously optimistic. A consensus “Moderate Buy” rating and a mean target price of $324.15 hint at an 18% upside, but there’s a clear caveat: FedEx needs to deliver on its bold promises.

Paccar: A Safe Bet or Playing It Too Safe?

Gates’ other big move—acquiring 1 million shares of Paccar (PCAR)—is equally intriguing. Based in Bellevue, Washington, Paccar designs and manufactures trucks under well-known brands like Kenworth, Peterbilt, and DAF.

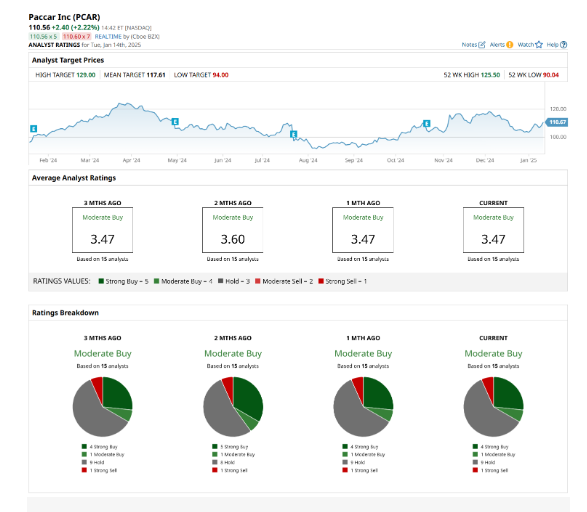

At first glance, Paccar seems like the safer bet. Its $110.40 share price reflects a solid 17% gain over the past year, even as the stock dipped 2.6% last month. With a P/E ratio of 12.08x, it’s reasonably priced, and a 1.22% dividend yield adds a layer of stability.

But is “safe” enough in a volatile economy?

Under the Hood

In Q3 2024, Paccar reported:

- Revenue: $8.24 billion.

- Net Income: $972.1 million ($1.85 per diluted share).

Those numbers are down from last year’s $1.23 billion net income, but operational efficiency is keeping the company afloat. Global truck deliveries hit 44,900 units, and analysts project Q4 earnings of $1.71 per share on $7.53 billion in revenue.

Strategically, Paccar is shedding non-core assets, like its Winch Division, to sharpen its focus on truck manufacturing and technology. The company also expects Class 8 retail sales in 2025 to reach 250,000 to 280,000 vehicles—a sign of potential growth.

Wall Street’s verdict? A “Moderate Buy” rating and a target price of $117.61, implying an 8.7% upside. Not jaw-dropping, but solid.

Should You Follow Gates?

Here’s the thing about Bill Gates: he doesn’t make random moves. His investments in FedEx and Paccar align with broader themes—economic recovery, falling interest rates, and the relentless growth of e-commerce. But even Gates isn’t immune to risk.

FedEx’s success hinges on executing ambitious plans, while Paccar must navigate a competitive landscape and economic uncertainty. Both companies have strong fundamentals, but the path ahead isn’t without bumps.

So, should you jump on the Gates bandwagon? Maybe. Just don’t forget to buckle up.

Where are the LA fires still burning, and why are they so destructive?