Warren Buffett has once again demonstrated the wisdom of his long-held mantra: “Be fearful when others are greedy and to be greedy only when others are fearful.”

The 94-year-old billionaire investor, often referred to as the Sage of Omaha, correctly positioned his portfolio ahead of Wall Street’s latest downturn, betting that Donald Trump’s policies would lead to a sell-off.

While Buffett never explicitly stated this, his actions spoke volumes. His conglomerate, Berkshire Hathaway, has been offloading billions of dollars in shares and holding onto cash instead.

Buffett has now sold more shares than he bought for nine consecutive quarters, including major stakes in high-profile companies. Last year, before Trump took office, he offloaded most of his Apple shares and trimmed positions in Bank of America and Citigroup.

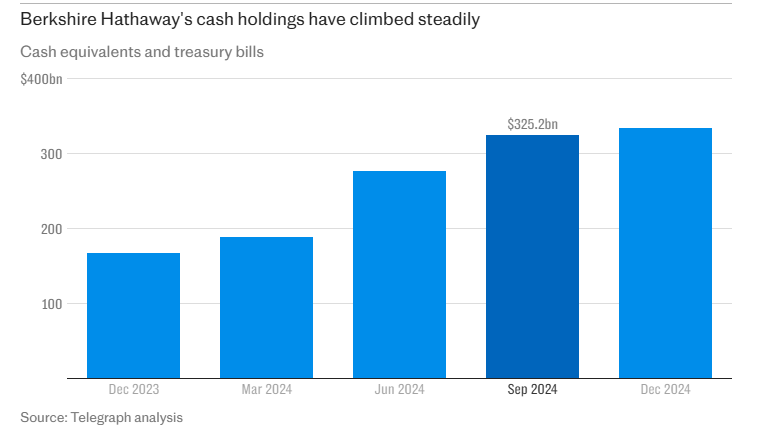

His cash reserves have now ballooned to an astonishing $334bn (£258bn) in recent months—more than a third of his total portfolio. To put that into perspective, this figure exceeds the combined value of all companies listed on the FTSE 100.

For some time, analysts had struggled to determine Buffett’s rationale for such a defensive stance, but it now appears he anticipated Trump’s trade policies would have a detrimental impact on U.S. markets.

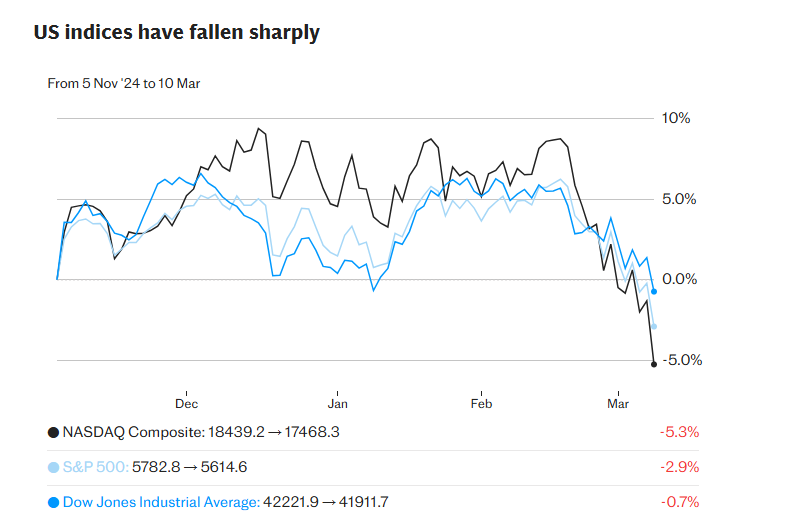

Wall Street took a hit on Monday, as fears over Trump’s tariffs raised concerns about a potential global recession. The Nasdaq, which features heavyweights like Nvidia and Apple, saw a staggering 4% drop—its sharpest single-day decline in three years.

For Buffett, this latest market slide validates his decision to shift from equities to cash.

“Buffett is one of these people who buys on the way up and decides to take money at the top,” says Michael Hewson, founder of MCH Market Insight.

Buffett executed much of his selling while Wall Street was still reaching record highs, as investors fueled a Trump-driven rally similar to the one seen during his first term. As recently as last month, the S&P 500 was closing at all-time highs.

Yet, in characteristic contrarian fashion, Buffett positioned himself for what has been dubbed the “Trump slump”—a market downturn spurred by stagnating economic growth.

“US markets are very expensive and he’s taking money off the table,” says Hewson. “The cash gives him optionality. Buffett is someone who puts his money where he gets the best return. He trades very much for the long term. He’s someone who’s happy to sit on the sidelines and doesn’t buy into the latest fads.”

Buffett, known as one of the most astute investors in history, has been a key figure in some of Wall Street’s most significant deals, often stepping in as a lender of last resort.

When hedge fund LTCM collapsed in the late 1990s, Buffett attempted to rescue it with a $250m bailout. During the financial crisis, Goldman Sachs turned to the billionaire for aid, securing a $5bn injection that helped keep the bank afloat—a deal that later earned Buffett a $3bn profit.

He has also borrowed tactics from the private equity playbook to acquire major corporations. Alongside Brazilian buyout firm 3G Capital, he took over Kraft Heinz, the global food conglomerate behind Heinz ketchup. When asked why he pursued the deal, Buffett gave a characteristically simple response: “Ketchup.”

In 2017, he made an ambitious $143bn bid to acquire Unilever, though the company ultimately rejected his offer.

Despite his shift toward cash, Buffett has pushed back against the idea that he is abandoning stocks. “Despite what some commentators currently view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities. That preference won’t change,” he assured shareholders last month.

Interestingly, one stock Buffett has been quietly accumulating is Domino’s Pizza.

However, with the U.S. stock market entering bubble territory, largely driven by the AI boom boosting companies like Nvidia, the recent slump may have been inevitable.

Hewson explains, “I don’t think he envisioned US markets coming off to the extent they have. The Nasdaq is still higher than it was a year ago but a correction was still well overdue.”

“Trump on his own wasn’t the catalyst because DeepSeek out of China has also been a factor. But it has sharpened the focus on whether these valuations are sustainable. Once one person starts to sell, you get a rush for the exits.”

As Wall Street tumbles, millions of investors are in panic mode. But if Buffett’s mantra holds true, now might just be the time to start buying.

New Canadian Leader’s Balancing Act: Negotiate With and Fight Trump