California’s housing market has undergone a significant shift. After four consecutive months of year-over-year inventory increases, the state is now firmly in a buyer’s market. Simply put, the supply of homes now exceeds the demand. Real estate analyst Nick Gerli summed up the situation bluntly: “no one is buying homes in California.”

According to a recent report by Realtor.com, home sales across the state remain just below the levels seen during the Great Recession. Skyrocketing prices and persistently high mortgage rates have pushed potential buyers to the sidelines, causing a buildup of unsold inventory.

Pandemic Trends and Long-Term Effects

The transformation began during the pandemic. Remote work allowed homeowners to flee expensive metropolises like San Francisco and Los Angeles for smaller cities—or leave the state entirely. While there was a brief dip in home prices in early to mid-2020, values quickly rebounded and continued to climb. That trend has now collided with economic headwinds.

“Historically high home prices are now playing a crucial role in keeping demand low in the state, together with mortgage rates still hovering just below the 7 percent mark and growing economic uncertainty linked to the effects of President Donald Trump’s tariffs,” the article notes.

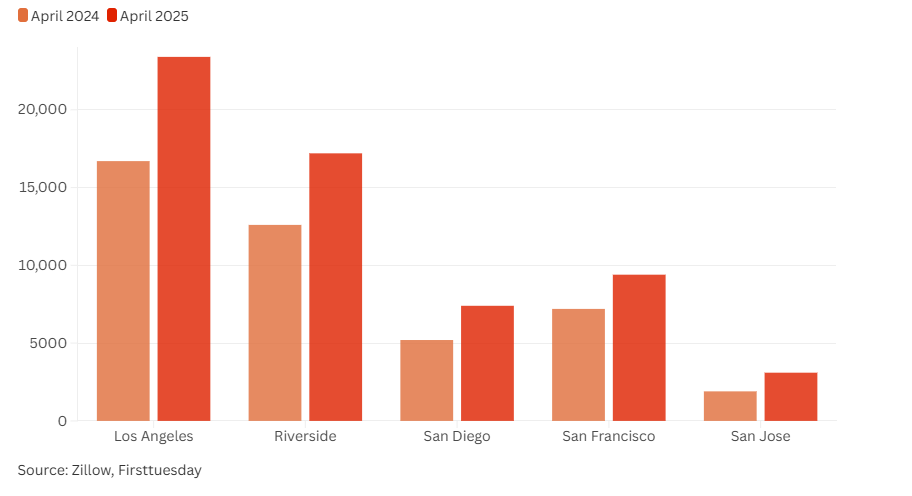

Inventory Climbs to Pre-Pandemic Highs

In May, Realtor.com reported 73,160 active listings in California—the highest since October 2019, just before the pandemic homebuying boom drastically reduced available housing. Oscar Wei, deputy chief economist at the California Association of Realtors, explained:

“The rate that housing inventory has been rising for the state is on par with that of the nation. At the national level, inventory of homes for sale rose more than 30 percent year over year in May, which is in line with the double-digit increase for the state of California.”

Wei emphasized that the spring season (April to August) typically brings more listings. “Homes are being bought during this time frame as many buyers want to settle down before schools start,” he said. Still, he cautioned that “the growth pace in active listings is slowing down, however, and the level of supply could reach a plateau sometime in June.”

Cities With the Largest Buyer-Seller Gaps

Several California cities ranked among the top 50 most populous U.S. metros with the greatest gaps between buyer demand and available inventory, based on a Redfin study. These included:

- Riverside (61.3% imbalance)

- Sacramento (44.9%)

- Los Angeles (44.8%)

- Anaheim (38.7%)

- Oakland (36.2%)

These figures suggest that while inventory is available, buyers are simply not entering the market at rates needed to absorb the supply.

Buyer Apathy Despite Growing Supply

In what should be encouraging news for homebuyers, the persistent inventory woes that plagued the state for years appear to be easing. But buyers are not responding. The state reported approximately 25,100 home sales in April—an increase of just 1.6 percent year-over-year.

Yet that figure remains “down 20 percent from the long-term average and 40 percent below the pandemic peak,” according to Gerli, CEO of Reventure App.

Oscar Wei offered insight into the problem:

“Economic uncertainty and elevated mortgage rates, which make costs of borrowing high, are primary factors that keep housing demand/home sales at low levels in recent months.”

“Insurance availability and affordability are also having a negative effect on home sales.”

Prices Begin to Slip

Nick Gerli noted on X: “This crisis in homebuyer demand is now causing home prices to drop.” Data from Reventure App confirmed this, showing a 0.42 percent drop in home values from March—marking the fourth consecutive month of declines and the fourth largest drop in the nation.

Gerli further explained:

“The reason prices are now dropping is because the low demand is being combined with a rise in listings.”

“Inventory had been low in California for much of the last couple years, but now it’s spiking.”

Despite the monthly drops, prices remain unaffordable for many. According to Realtor.com, the average home value in April was $796,255—up 1.3 percent from the previous year. Redfin put the median sale price even higher at $854,700, reflecting only a modest 0.2 percent annual increase.

Back in April 2020, a typical California home cost about $571,000.

Discounts on the Rise, Premiums Fading

While some price relief is visible, it’s limited. In April, 34.8 percent of homes sold in California did so with a price cut—a 10.2 percent increase year-over-year. At the same time, only 40.3 percent of homes sold above list price, down 9.7 percent from April 2024.

This suggests sellers are slowly adjusting to the new reality. Redfin Senior Economist Asad Khan noted:

“The balance of power in the U.S. housing market has shifted toward buyers, but a lot of sellers have yet to see or accept the writing on the wall. Many are still holding out hope that their home is the exception and will fetch top dollar.

But as sellers see their homes sit longer on the market and notice fewer buyers coming through on tour, more of them will realize that the market has adjusted and reset their expectations accordingly.”

What Analysts and Experts Are Saying

Oscar Wei told Newsweek that buyers are playing the waiting game:

“Buyers are waiting for the costs of homeownership to come down. That could mean lower mortgage rates or lower home prices. Mortgage rates should slowly decline and will likely moderate slightly by the end of the year.”

“The market may have already seen the peak price for the year and could soften in the next few months.”

Hannah Jones, senior economic research analyst at Realtor.com, wrote:

“Home price growth accelerated in California during the early days of the [COVID-19] pandemic, driving the state’s median listing price to new heights. High home prices and rising mortgage rates put homeownership out of reach for many would-be buyers.”

Wolf Richter echoed that sentiment:

“The problem is demand in California. It has essentially collapsed. New listings aren’t that high. But because the inventory of homes for sale doesn’t sell, and new listings are added to it, the total piled up.”

Lance Lambert also noted:

“More California housing markets are climbing out of that inventory deficit. And if the current trajectory holds, California could soon be out of its Pandemic Housing Boom era inventory hole.”

What’s Coming Next

Analysts anticipate mild home price declines by the end of the year across California. Zillow projects price drops in 31 cities, including:

- San Francisco: -5.2%

- San Jose: -3.8%

- Sacramento: -3%

- Los Angeles: -1.2%

- San Diego: -0.7%

Oscar Wei confirmed this trend:

“Home prices should begin to come down from the record high set in April as we enter the second half of the year.

Seasonality will play a role in the price moderation, and an increase in housing supply will also relieve some upward price pressure.”

He continued:

“We expect price crops across the state to be mild but the changes between months could appear volatile in some areas because of their low number of observations. In general, we still expect a mild single-digit year-over-year increase for the year as a whole for the state and most regions.”

Conclusion

California’s housing market is no longer what it once was. High mortgage rates, economic uncertainty, and years of inflated home prices have brought demand to a near standstill. Inventory is growing, but buyers are not biting. The result: a softening market with price cuts becoming more common—but affordability remains elusive. Whether this turns into a full correction or a prolonged freeze will depend on interest rates, economic policy, and how long sellers can wait.

Gundlach Issues Stark Warning on U.S. Economy: “A Reckoning Is Coming”