Just weeks ago, Moody’s chief economist Mark Zandi expressed cautious optimism about the housing market. But that tone has changed sharply. In a July 13 post on X, Zandi escalated his concern, warning that home sales, homebuilding, and even house prices are set to slump unless mortgage rates fall materially from their current 7% range—something he believes is unlikely.

“The housing downturn to date has been mostly about the depressed existing home sales,” Zandi told ResiClub. “New home sales, housing completions, and house prices have held up well—that’s about to change.”

From Yellow to Red: Zandi’s Escalating Warning

Back in May, during a conversation with Gunnar Branson, CEO of the Association of Foreign Investors in Real Estate (AFIRE), Zandi described the housing softening as “yellow flares,” noting that the economy still appeared resilient. That caution has since turned into a clear signal of distress.

Why Builders Are Pulling Back

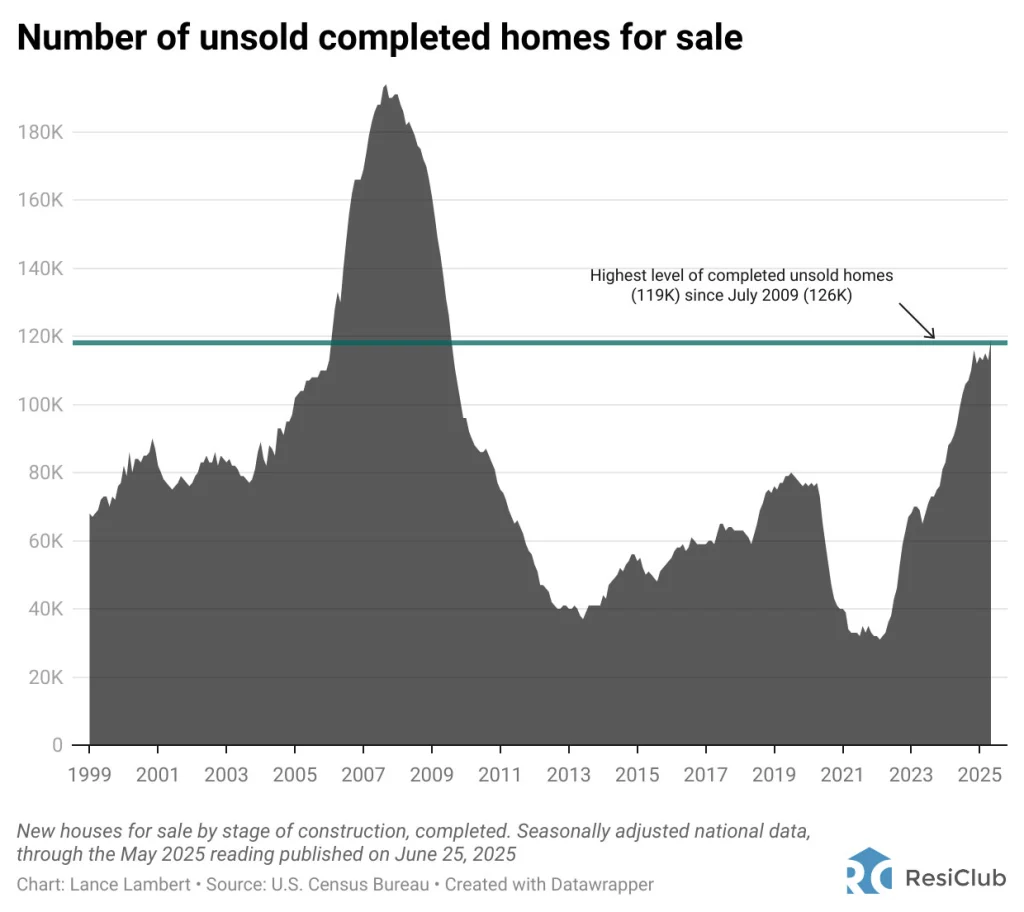

Zandi pointed to builders now postponing land deliveries—an early sign that construction activity may slow down.

According to ResiClub’s analysis of U.S. Census Bureau data, the number of unsold completed homes hit 119,000 in May 2025, marking the highest level since July 2009, when the figure reached 126,000. Zandi says it’s not surprising that homebuilders are scaling back, given that unsold inventory has hit another 15-year high.

Slump Spreading Beyond Existing Home Sales

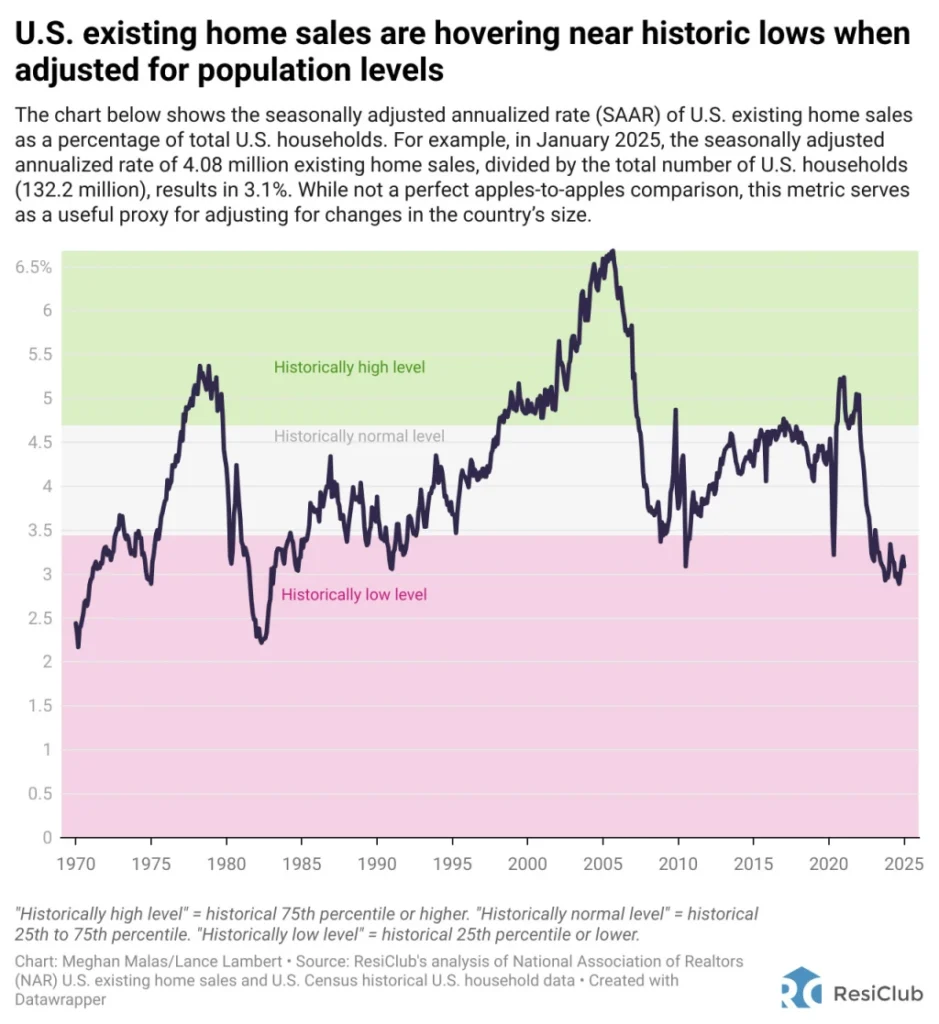

Since mid-2022, the housing market has been in a slump. Existing home sales have remained at historic lows, job losses in the sector have mounted, and mortgage brokers and agents have seen commissions slashed as transaction volumes dried up.

So far, the housing downturn has largely impacted only existing home sales. But Zandi warns that the slump is broadening. The next phase could drag down new home prices and significantly affect construction activity.

Price Cuts Expected, Especially in the South and West

Zandi told ResiClub he expects national house prices to decline by a mid-single-digit percentage from peak to trough over the next 18 to 24 months, assuming mortgage rates remain around 7%.

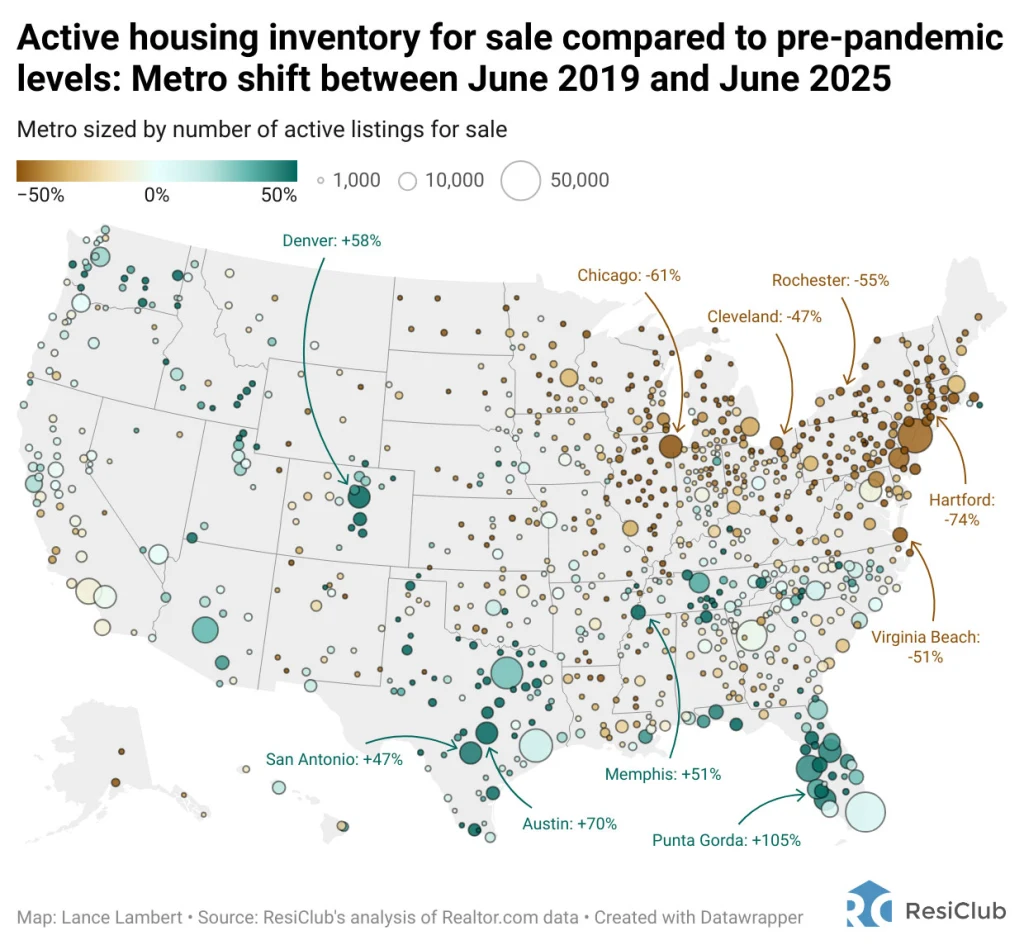

“Prices will be weakest in the South and West, where affordability is lowest and there has been more construction,” Zandi said.

These regions, which experienced significant home price growth during the pandemic—often outpacing local income levels—are now facing softening demand and rising inventory.

Incentives Losing Steam in Hot Metro Areas

Builders in cities like Austin, Phoenix, and Tampa have tried to keep prices high using incentives like mortgage rate buydowns. But as those tools become less effective or more expensive, builders are beginning to cut prices outright, creating pressure in both new construction and resale markets.

Meanwhile, the Northeast and Midwest markets—where pandemic-era migration and new construction were more limited—have seen more price stability, thanks to tighter inventory and fewer price reductions.

Zandi’s Takeaway: A Broadening Downturn

In Zandi’s view, the housing downturn is evolving. What began as a slowdown in existing home sales—driven by affordability constraints and mortgage rate lock-ins—is now spreading to new home construction and pricing, especially in overheated markets.

“The housing downturn to date has been mostly about the depressed existing home sales. New home sales, housing completions, and house prices have held up well—that’s about to change.”