Ethereum co founder Vitalik Buterin weighed in on prediction markets, stating that “most major prediction markets don’t pay interest,” which makes them “very unappealing for hedging.” He added that users would have to “sacrifice a guaranteed yield of around 4% annual percentage yield available on stable dollar denominated assets in order to participate.” “I expect lots of hedging use cases to open up once that gets solved and volumes increase more,” he said. The Block

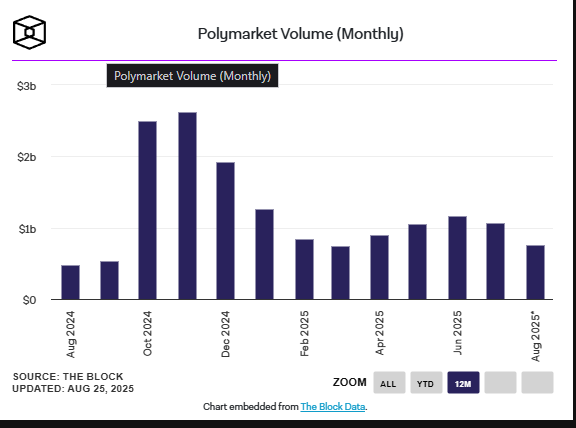

Polymarket volume fell last month, with “$1.06 billion in July, down from $1.16 billion in June,” while “the number of active traders on Polymarket rose to 286,730 in July from 242,340 in June.” “The average user traded smaller in July even as the platform’s total users grew,” according to The Block’s research. The number of new markets “has consistently increased every month since Polymarket’s inception.” The Block+1

Why Interest Matters for Hedging

Hedgers generally compare the cost of capital in a position against a risk free or near risk free yield. Buterin’s point is that if a prediction market forces capital to sit idle in non interest bearing collateral, a systematic yield penalty appears. That penalty is visible when short term dollar yields hover near 4%–5%, and it grows more salient as cash like returns increase. The Block

Academic and practitioner primers note that market design determines “capital choices and distribution of winnings,” with some platforms using order books and others automated market makers. Those choices affect how collateral is posted and whether idle funds can earn a return while a market is open. wifpr.wharton.upenn.edu

In practical terms, a hedger evaluating a tail risk event or an earnings style outcome must weigh not only fees and slippage, but also the “opportunity cost” of forgoing safe yield. When base rates are meaningful, that cost can dominate. Industry commentary has framed the bottleneck bluntly: “a lack of interest on both the supply (liquidity provider) and demand (bettor) side.” Gate.com

Can Interest Bearing Dollars Solve It?

A growing set of tokens attempts to pass through yield from underlying assets or strategies. Overviews describe “interest bearing stablecoins” (also called yield bearing stablecoins) that “embed off chain yields into the tokens themselves” or route deposits into money market assets to “provide daily interest.” Examples discussed across explainers include USDY (Ondo Finance), USDM (Mountain), USDe/sUSDe (Ethena), and DAI’s savings rate variants. Each uses different mechanisms to source yield, from Treasuries to basis trades. MediumOKXFinancial Times

These designs vary in risk. Analyses caution about “smart contract vulnerabilities, protocol mismanagement, and market fluctuations,” and journalism covering synthetic dollars adds that funding rate strategies can compress as more capital crowds in, taking yields “from over 60% to under 5% annualized within a year.” Such compression underlines that yield is neither guaranteed nor static. OKXFinancial Times

If prediction markets could accept interest bearing dollars as collateral—while safely crediting daily yield to positions—Buterin’s concern would be directly addressed. The architecture challenge is crediting that yield without breaking market fairness, settlement, or regulatory constraints. A stablecoin research survey separates custodial versus non custodial models and highlights the trade offs between trust, transparency, and stability—trade offs prediction markets would inherit the moment they embed yield. berkeley-defi.github.io

America’s Stalled Mobility: Housing Costs and Job Insecurity Keep People Stuck

The Regulatory Backdrop

U.S. oversight of “event contracts” has been a live issue, with legal scholarship arguing the CFTC can compel delistings of products that don’t meet public interest standards, pushing some contracts toward treatment under state gambling laws. Platforms that try to incorporate yield bearing instruments must account for these overlays. businesslawreview.uchicago.edu

Stablecoin rules are also evolving. Recent reporting highlights how U.S. banking groups and policymakers are tussling over whether and how interest can be paid on stablecoins. The policy direction matters: if yield on tokenized dollars becomes widespread—or is explicitly constrained—prediction markets’ collateral choices will change accordingly. Financial Times

Polymarket’s Recent Numbers in Context

The Block’s dashboard shows Polymarket’s monthly volume slipping from June to July, while active traders increased. That combination—more participants, smaller average tickets—fits Buterin’s framing: users may be more willing to “show up,” but they curb size when the platform does not offset the risk free yield they could otherwise earn. The Block’s researchers wrote that “the average user traded smaller in July even as the platform’s total users grew,” and emphasized that new market creation “has consistently increased every month,” signaling diversification beyond “the platform’s early politics heavy focus.” The Block

Third party summaries of the same dataset characterize July as an 18% jump in active traders after a slump, again paired with smaller average trade sizes. The directional takeaway is consistent: breadth up, depth muted. TodayOnChain.com

Design Paths That Could Reduce the Yield Penalty

1) Interest Passing Collateral.

Allow collateral types that natively accrue yield, with transparent, programmatic crediting to open positions. A whitelist could include tokenized T bill funds or yield bearing stablecoins, subject to risk caps. Industry coverage shows both conservative (Treasury backed) and synthetic (basis trade) approaches; platforms would need risk committees and disclosures to reflect the differences. Financial Times

2) Protocol Level Rebates.

If direct yield pass through is infeasible, markets could rebate a portion of fees to hedgers proportional to time weighted collateral posted, offsetting some of the opportunity cost. Primers emphasize how mechanism design shapes incentives; a rebate schedule is one such mechanism. wifpr.wharton.upenn.edu

3) Shorter Tenors and Early Resolution.

Liquidity concentrates where capital turns quickly. By encouraging markets with shorter resolution windows—or by enabling partial settlement upon credible interim milestones—platforms can reduce time in market and thus the foregone yield.

4) Cross Margining and Netting.

Sophisticated hedgers care about capital efficiency. Cross-margin engines that net exposures across related markets can reduce idle collateral and the associated yield drag.

5) Clear Legal Pathways.

Uncertainty adds an implicit “regulatory risk premium.” Progress on event contract guidance, plus clarity on stablecoin yield permissibility, could lower the hurdle rate hedgers demand to participate. businesslawreview.uchicago.eduFinancial Times

Where This Leaves Prediction Markets

Commentary on adoption has argued that prediction markets aren’t yet a “natural savings device,” nor do they function like traditional entertainment betting, which limits the organic inflow of saver and gambler capital. That structural middle ground makes design tweaks—especially around yield—more critical. worksinprogress.co

If platforms can neutralize the yield penalty without adding unacceptable risk, Buterin’s view points to a plausible next leg of growth: “hedging use cases” that attract corporates, funds, and sophisticated individuals who currently sit out. The most credible path is pairing conservative, transparent yield sources with clear risk disclosures—avoiding designs that hinge on volatile funding rate trades whose returns can compress sharply. Financial Times

Key Quotes (from the source you shared)

- “Most major prediction markets don’t pay interest,” making them “very unappealing for hedging.”

- Users would have to “sacrifice a guaranteed yield of around 4% annual percentage yield available on stable dollar denominated assets in order to participate.”

- “I expect lots of hedging use cases to open up once that gets solved and volumes increase more.”

- Polymarket “recorded $1.06 billion in volume in July, down from $1.16 billion in June.”

- “The number of active traders on Polymarket rose to 286,730 in July from 242,340 in June.”

- “The average user traded smaller in July even as the platform’s total users grew.”

- New markets have “consistently increased every month since Polymarket’s inception.” The Block

Bottom Line

Buterin’s critique targets a simple friction: idle capital that earns no interest while a market is open. With cash yields elevated, that friction becomes a hard stop for hedgers. The data—lower volume, more users, smaller tickets—suggests broader participation without deep risk allocation. Solving for interest bearing collateral, or otherwise offsetting the foregone yield, is the design unlock prediction markets may need to convert attention into sustained hedging flow. The Blockwifpr.wharton.upenn.eduFinancial Times

Sources

- The Block: Vitalik Buterin’s comments and Polymarket metrics; The Block Data dashboard. The Block+1

- Wharton Public Policy Initiative: Market design primer. wifpr.wharton.upenn.edu

- FT analysis of Ethena/USDe and yield dynamics. Financial Times

- OKX Learn explainer on interest bearing stablecoins and risks. OKX

- Works in Progress essay on why prediction markets aren’t popular. worksinprogress.co

- Gate Learn article on prediction market bottlenecks. Gate.com

- University of Chicago Business Law Review on event contract regulation. businesslawreview.uchicago.edu

- FT report on stablecoin interest policy dispute. Financial Times