The big three insurers, State Farm, Nationwide, and Farmers, have issued statements to reassure Californians affected by wildfires, though residents in Los Angeles face an intensifying home insurance crisis.

“As wildfires devastate Los Angeles, the destruction of lives and homes is not the only challenge California residents are facing,” reports The U.S. Sun. “The unrelenting fires have caused a home insurance crisis in The Golden State, with many big insurers pulling coverage and leaving homeowners with limited options.”

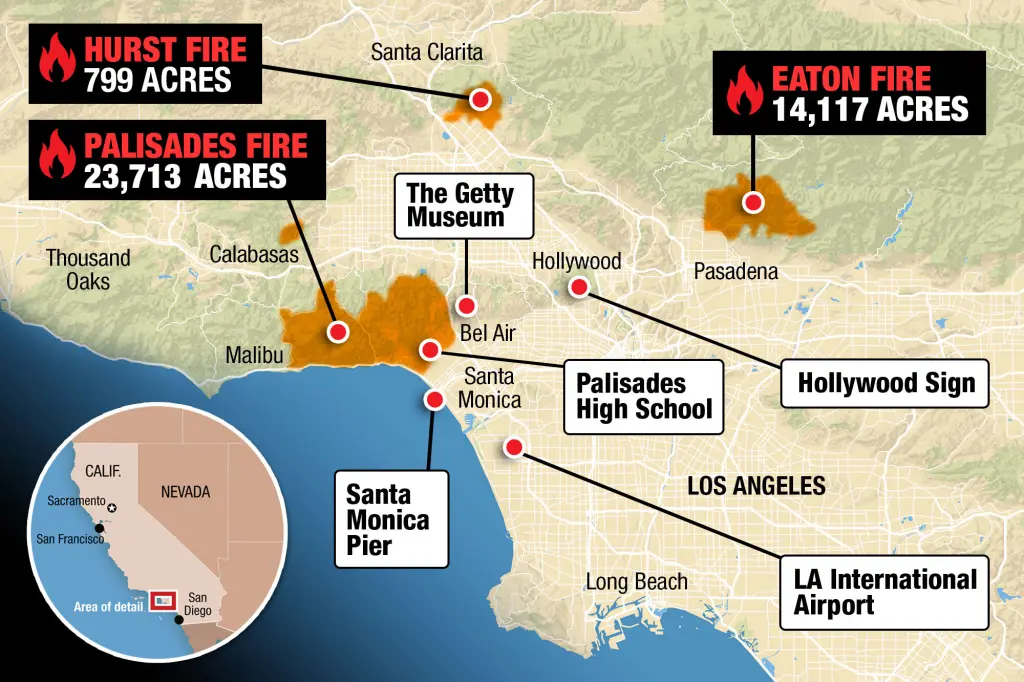

Southern California has been grappling with wildfires since January 7, including the devastating Palisades Fire in Los Angeles’ affluent Pacific Palisades neighborhood. “The fire … could become the most destructive fire in state history,” according to the Sun.

Wildfire Losses Mount

The catastrophic fires have claimed 24 lives so far, displaced hundreds of thousands under evacuation orders, and scorched over 40,500 acres. Meanwhile, JPMorgan analyst Jimmy Bhullar has warned:

“The fires have not been contained thus far and continue to spread, implying that estimates of potential economic and insured losses are likely to increase.”

With potential insured losses now expected to surpass $20 billion, major insurers have opted to scale back operations in California. “State Farm, Nationwide, and Farmers are pulling out of the state,” confirms The U.S. Sun. “These big insurers have cut coverage and canceled home insurance policies in areas at risk of wildfires to avoid more losses.”

Wealthy Residents Relocate

In response to these fires and mounting insurance woes, many L.A. residents are leaving the region entirely. Speaking with Fox Business’ “The Claman Countdown”, real estate mogul Ryan Serhant noted:

“We’ve started facilitating rentals, but now those are about to turn into purchases.”

He added that calls for East Coast relocation surged:

“They are moving to Connecticut, New Jersey, parts of Long Island, the Hamptons, New York City … and across Florida.”

Realtor.com emphasized the deeper trend: “Even before the fires overwhelmed Los Angeles, people have been leaving California in droves. That trend started during the COVID-19 pandemic in 2020 and continued into last year.”

Insurers Stay Strong Amid Fires

Even as residents struggle, insurers are seeing their stocks rebound. Barron’s reports, “Shares in some of the bigger publicly listed insurers with exposure to California were either rising or treading water.”

“Severe weather could actually help the insurers by enabling them to raise premiums,” noted Jefferies analyst Yaron Kinnar.

Analysts now estimate industry-wide insured wildfire losses of $20-$25 billion, according to Evercore ISI. Meanwhile, Cal Fire officials warn of worsening conditions with “Santa Ana winds topping 70 miles per hour, potentially spreading fires further.”

California Wildfires Ignite Financial Chaos: Why Wall Street and Homeowners Are Alarmed