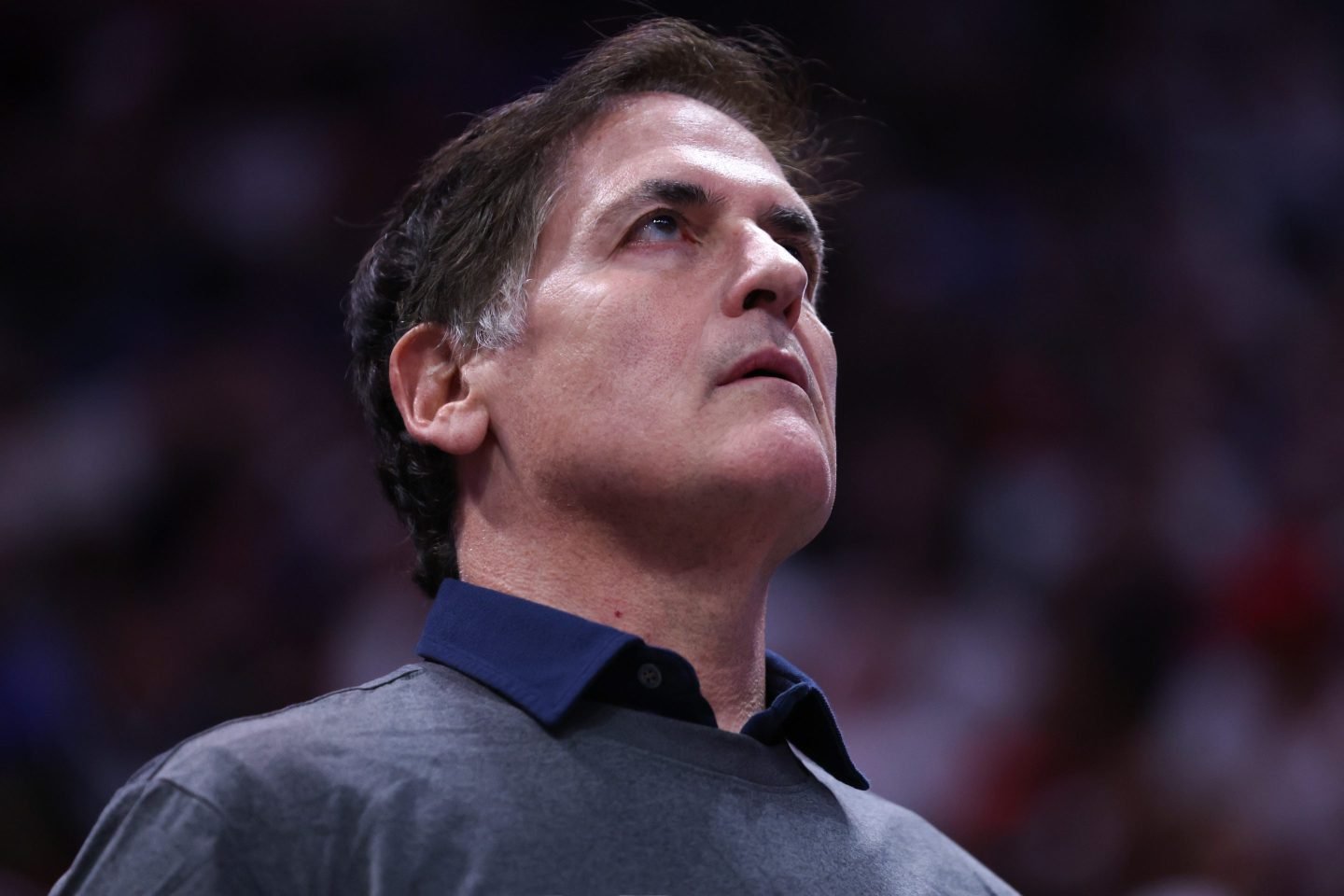

Billionaire investor Mark Cuban has warned that the federal government’s abrupt and deep spending cuts are rippling through the economy, creating conditions that could lead to a downturn.

Cuban’s Warning on Bluesky

In a post on Bluesky on Sunday, Cuban responded to a discussion about federal contractors furloughing staff and slashing pay.

“This is a bigger issue than people realize. Not just jobs lost. But their families losing benefits. Landlords losing tenants. Cities and towns losing revenue. This is how recessions start,” Cuban wrote. “Ready Fire Aim is no way to govern.”

Weak Job Market Signals Trouble

Recent data on the labor market has raised concerns. On Wednesday, ADP’s survey of private-sector payrolls reported that only 77,000 jobs were added in the past month, significantly below the expected 148,000 and January’s gain of 186,000.

Education and health services—industries reliant on government spending—saw a decline of 28,000 jobs. Meanwhile, trade, transportation, and utility businesses, which would be affected by President Donald Trump’s tariffs, shed 33,000 jobs.

“Policy uncertainty and a slowdown in consumer spending might have led to layoffs or a slowdown in hiring last month,” ADP Chief Economist Nela Richardson said in the report. “Our data, combined with other recent indicators, suggests a hiring hesitancy among employers as they assess the economic climate ahead.”

Beats Powerbeats Pro 2 Wireless Bluetooth Earbuds – Noise Cancelling, Apple H2 Chip, Heart Rate Monitor, IPX4, Up to 45H Battery & Wireless Charging

Massive Layoffs Following Spending Cuts

The impact of federal spending cuts became clearer on Thursday when Challenger, Gray & Christmas reported that employers announced 172,017 layoffs last month—a 245% surge from January and the highest since July 2020.

The staffing firm estimated that about one-third of those cuts, or 62,242 jobs, could be attributed to Elon Musk’s Department of Government Efficiency (DOGE).

“With the impact of the Department of Government Efficiency [DOGE] actions, as well as canceled Government contracts, fear of trade wars, and bankruptcies, job cuts soared in February,” Andrew Challenger, senior vice president and workplace expert for Challenger, Gray & Christmas, said in the report.

Government Job Losses and the 18F Office Closure

On Friday, the Labor Department reported a gain of 151,000 jobs in February, falling short of forecasts for 170,000. While overall hiring remained positive, the report showed federal government employment declined by 10,000. The data did not fully capture a recent wave of cuts, meaning the next jobs report could reflect a more significant impact.

Among those affected was the General Services Administration’s 18F office, which developed software and technology to improve efficiency across federal agencies.

In a separate Bluesky post, Cuban suggested those laid off from 18F should form a consulting company—and even offered to invest in it.

“It’s just a matter of time before DOGE needs you to fix the mess they inevitably create,” he wrote. “They will have to hire your company as a contractor to fix it. But on your terms.”

Economic Indicators Flash Warning Signs

Meanwhile, other economic indicators and financial markets are signaling potential trouble ahead. The Atlanta Fed’s GDPNow tracker now predicts a 2.4% contraction for the first quarter, a sharp decline from 2.3% growth projected on Feb. 19.

While the indicator is known for volatility, Wall Street analysts have grown increasingly cautious.

Market Experts Warn of Rising Recession Risks

In an op-ed on Wednesday, market experts Ed Yardeni and Eric Wallerstein stated they still see a 55% chance of a “Roaring 20s” scenario in which the U.S. economy continues to grow, fueled by technology-driven expansion.

However, they cut the odds of a bullish “meltup” to 10% from 25%, while raising the chances of a bear market and a tariff-induced recession to 35% from 20%.

“We are still betting on the resilience of consumers and the economy,” they warned. “However, Trump Turmoil 2.0 is significantly testing the resilience of both.”

The US penny costs nearly 4 cents to make. But for one sector of souvenir sellers, it’s a living