Chaos in the U.S. stock market has now spilled over into the $28.6 trillion Treasury market, and one prominent Wall Street economist believes hedge funds abandoning a popular strategy may be the cause.

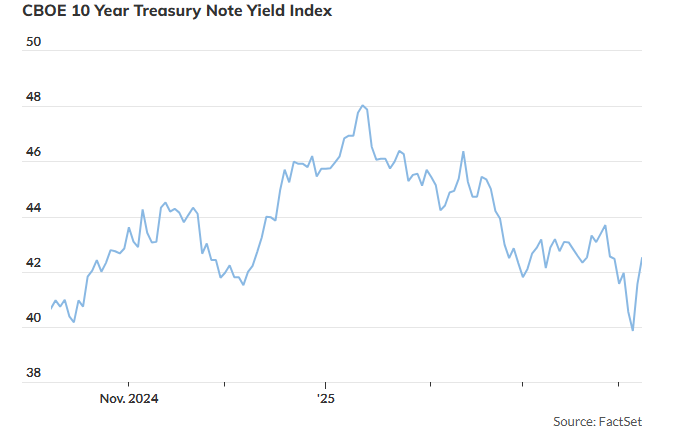

Torsten Slok, chief economist at Apollo, pointed to a dramatic unwinding of the so-called Treasury basis trade as a major contributor to Monday’s sharp moves. The 10-year Treasury yield spiked by 17.2 basis points, burning investors who had just sought safety in the bond market.

“Something very unusual happened in financial markets yesterday. Long-term interest rates went up 20 basis points despite stocks going down. One potential reason for the move higher in rates is an unwind of the basis trade,” Slok said in emailed commentary.

Yields on the Rise

Treasury yields extended their climb on Tuesday:

- The 10-year note yield rose 3 basis points to 4.217%

- The 30-year bond yield added 3 basis points to 4.641%

- The 2-year note yield increased by 5 basis points to 3.817%

The Basis Trade: A Risky Arbitrage

According to the Federal Reserve, basis trades aim to profit from price discrepancies between Treasury futures and similar Treasury bonds. As futures near expiration, their price and the underlying bonds converge, creating a window for profit.

Slok explained:

“In case of an exogenous shock, the highly leveraged long positions in cash Treasury securities by hedge funds are at risk of being rapidly unwound.”

The strategy has ballooned to around $800 billion, and the concern is what happens if a full-scale unwind is triggered. Monday’s episode offered a preview of potential fallout.

A Fragile System Propped by Leverage

Slok warned:

“Such an unwind would have to be absorbed, in the short run, by a broker-dealer that itself is capital-constrained. This could lead to a significant disruption in market functions of broker-dealer firms, such as providing liquidity to the secondary market for Treasuries and intermediating the market for repo borrowing and lending.”

The Treasury market is often dubbed the world’s most important financial market. Its yields influence interest rates on trillions in loans — from mortgages to corporate credit. A shock to this market would ripple globally.

Warnings from the Fed

Federal Reserve economists have previously noted that although the Treasury market has benefited from basis trade activity, the heavy use of leverage has made it more fragile.

A March report by Bloomberg News revealed that a panel of financial experts had suggested the Fed should consider an emergency facility to help unwind these leveraged trades smoothly, should trouble erupt.

Other Possible Causes: Tariffs and Inflation Fears

While basis trades were a top suspect, others raised different flags. Some speculated that foreign central banks were dumping their Treasury holdings. But Jim Bianco of Bianco Research wasn’t convinced.

Bianco argued on X that “if foreign reserve managers had been dumping Treasurys, then the dollar likely would have weakened. But instead, the greenback strengthened.”

Another concern: Trump’s proposed tariff policy. Some fear it could drive inflation higher, just like in 2022, when a historic inflation wave triggered a rare dual sell-off in both stocks and bonds.

Echoes of Liz Truss?

Bilal Hafeez, CEO of MacroHive, issued a stark warning. He said Trump’s proposed policies might lead to similar chaos that forced U.K. Prime Minister Liz Truss from office in 2022. A poorly received mini-budget then triggered a meltdown in British sovereign bonds.

Neil Dutta of Renaissance Macro has also drawn parallels between Trump and Truss, highlighting the risk of economic turbulence tied to aggressive fiscal policies.

A Quick Stock Market Rebound

Despite the bond market carnage, equities rebounded sharply on Tuesday:

- The S&P 500 gained 2.8%, hitting 5,206

- The Dow Jones Industrial Average jumped 1,023 points or 2.7%, to 38,988

- The Nasdaq Composite soared 522 points or 3.3%, reaching 16,123

The turmoil in Treasurys — “the world’s most important financial market” — is a signal of just how fragile the current landscape is, especially with high leverage, tariff fears, and inflation pressures converging all at once.

China’s US Debt Leverage in Escalating Tariff Standoff with Trump