In 2001, Warren Buffett devised an indicator which he described as “probably the best single measure of where valuations stand at any given moment.” He also warned that if it approaches 200%, an investor is “playing with fire.”

In the US, it’s currently (29 August) at 214%.

Expressed as a percentage, the Buffett indicator compares the gross domestic product of a particular economy with the value of that country’s stock market. “It’s really a market-wide price-to-earnings ratio.”

And driven by the artificial intelligence (AI) boom, “it’s never been higher.”

What This Could Mean

Its present elevated level could be “an indication that a market correction is coming.” And as the saying goes, “when America sneezes, the world catches a cold.”

If an investor thought the stock market was overheating, “they might consider selling equities and moving into other asset classes, most notably cash.”

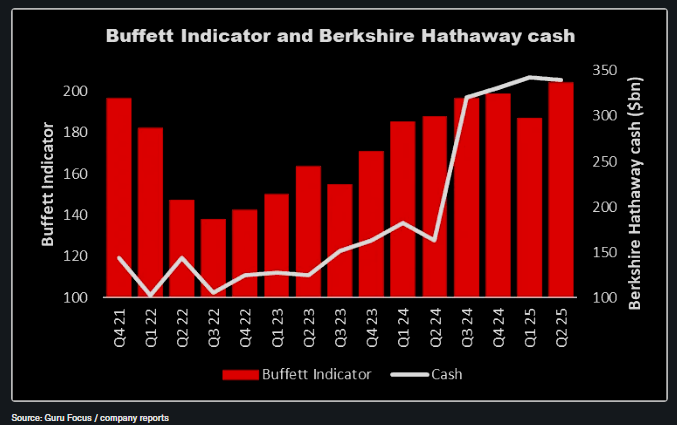

Looking at Berkshire Hathaway, Buffett’s investment vehicle, “during the quarter ended 30 June, the group sold more stocks than it purchased.” This reflects a recent trend “towards holding more cash and Treasury bills (a proxy for cash).”

At the same time, “Buffett’s indicator has been steadily rising.” For the statistically-minded, “the two variables have been 69% correlated since the end of 2021.”

Buffett’s Own Position

But in his 2024 letter to shareholders, Buffett reminded investors that “the great majority of your money remains in equities.” He also made it clear that “Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses…”

The article notes: “I suspect Buffett is being cautious.” Over his long career, “he’s seen plenty of market corrections — and some crashes, too.”

“History tells us that, inevitably, there will be another pullback but nobody knows when.” However, when this happens, “Berkshire Hathaway will be in a strong position to pick up some bargains.” It’s likely that Buffett’s firm “has a list of potential stocks that it could buy with some of its $350bn of cash when the time is right.”

Also Read: Bond Market Pressure Could Force Social Security and Medicare Cuts, Economist Warns

A Stock to Watch

“One company on my watchlist is RELX (LSE:REL). Its stock isn’t cheap but I think its strong valuation can be maintained.”

That’s because “it’s incorporating AI into its information-based analytics and decision tools across its four divisions.”