Brace yourself—it’s a chaotic time for global bond markets. Government-bond yields, the bedrock of borrowing costs, are on a steep ascent almost everywhere. Take American Treasury bonds: yields on ten-year notes have jumped to 4.7%.

Across the Atlantic, German bunds now hover at 2.6%, up from nearly 2% just last month. Meanwhile, British gilt yields reached an eye-watering 5%, their highest point since the financial crisis of 2008. For borrowers—from governments to the average mortgage-holder—this spells trouble.

Higher yields translate into more painful payments for debt service, hitting household budgets and national coffers alike.

So, what’s driving this volatility? Here’s a deep dive into the complex forces roiling bond markets and why it’s rattling the global economy.

Inflation: The Perennial Culprit

Inflation continues to hog the spotlight. Rising consumer prices push investors to demand higher yields to offset the anticipated erosion of future purchasing power. For example, on January 15th,

American bond yields saw a modest drop after inflation data surprised traders with a slightly tamer reading—annual inflation hit 2.9% in December, lower than expected.

Still, inflation in major economies remains stubborn. In the G7, nominal wages are increasing by 4.5% annually—enough to keep inflation above central bank targets, given sluggish productivity growth.

Europe may be heating up further, with wage growth accelerating and inflation expectations ticking upward. It’s clear: inflation isn’t done flexing its muscle.

The Elusive “Term Premium”

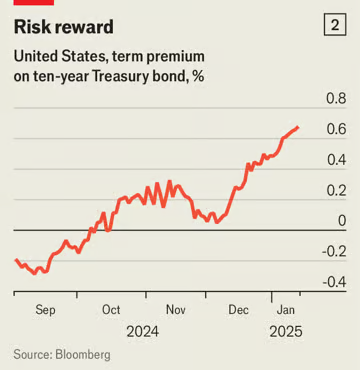

Yet inflation alone doesn’t tell the full story. Lately, much of the rise in bond yields stems from uncertainty over what lies ahead. This uncertainty drives up the “term premium”—an additional yield investors demand to hold long-term bonds. Why? To compensate for the risk that future rate hikes might torpedo bond prices.

Case in point: in the U.S., term premium increases account for nearly all the uptick in ten-year Treasury yields since December. Fear of unexpected inflation or central banks doubling down on hawkish policies keeps investors skittish—and drives yields higher.

Lo & Sons Original Catalina Deluxe Premium Canvas Duffel Bag – Travel, Gym, Hospital, or Weekender Bag with Shoe Compartment for Men and Women

Politics, Growth, and Trade Wars: The Perfect Storm

Let’s throw geopolitics and economic policy into the mix. In America, concerns about potential tariffs or labor market disruptions under Donald Trump’s immigration policies amplify inflation fears.

At the same time, trade tensions with China loom large. Imagine a scenario where China devalues its yuan—markets would face a deflationary shock that could ripple globally.

Then there’s the wild card of economic growth. Some worry about the drag of deglobalization and China’s slowing momentum.

Others believe breakthroughs in productivity (looking at you, AI) or Trump’s tax cuts could turbocharge growth. The result? Markets veer between extremes, keeping the term premium elevated.

Fiscal Policy and QT: Adding Fuel to the Fire

Governments are not exactly helping matters. G7 nations plan to run an average budget deficit of 6% of GDP in 2025—a staggering number, considering unemployment is low and economies are humming along.

Issuing bonds to fund these deficits swells supply, putting downward pressure on prices and forcing yields higher.

Take the U.S., which expects to issue $2 trillion worth of debt this year. Goldman Sachs estimates that every percentage point added to the deficit-to-GDP ratio bumps long-term yields by 20 basis points.

Add the fact that central banks are selling bonds—thanks to quantitative tightening (QT)—and you’ve got a glut in the market, exacerbating the issue. In the G7, QT alone could double the effective volume of bonds available for sale.

What’s Next for Bond Markets?

Prediction is a treacherous game, but here’s where we stand. Yields may ease slightly in some countries, such as Britain, where bond issuance is expected to drop. Elsewhere, inflation fears could subside, offering some relief.

However, the larger forces driving yields higher—ballooning deficits, persistent inflation risks, and geopolitical tensions—aren’t going away anytime soon.

To put it in perspective, today’s term premium remains a shadow of its former self. Back in the inflation-ravaged 1970s and 1980s, it was measured in full percentage points, not fractions.

If investors misjudge the central bank’s willingness to keep raising rates, bondholders may ditch sovereign debt entirely, unleashing even higher yields.

The Bottom Line

Rising bond yields have set off shockwaves from mortgage markets to government budgets, leaving policymakers and borrowers grappling with the consequences.

As inflation simmers, geopolitical uncertainty rises, and fiscal excesses mount, the bond market rollercoaster looks set to continue. If you’re taking out a mortgage, navigating corporate financing, or tracking global financial health, keep an eye on these trends—they’ll dictate the road ahead.

TikTok Banned in the US: The Rise of RedNote as a Surprising Alternative