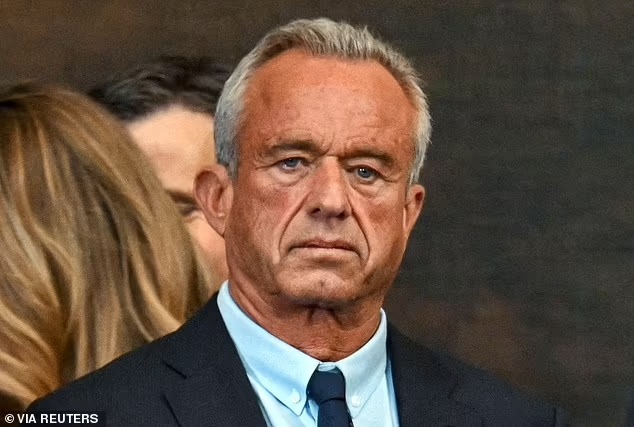

President Trump’s “Make America Healthy Again” campaign, started by Robert F. Kennedy Jr., has raised questions about which businesses will profit from the administration’s renewed emphasis on public health.

Kennedy, who is currently the head of the Department of Health and Human Services, has advocated for school lunches to contain fewer processed foods and sodas because they are “chemical poisons.”

His vocal condemnation of corporate interests that put profits ahead of public health not only targets the food industry but also medications and vaccinations.

Kennedy contends that these allegations are linked to the fact that, despite spending more on healthcare than any other nation, the United States continues to rank among the sickest and has a lower life expectancy than countries like the UK, Canada, and Australia.

A Fresh Perspective on Food Additives

In response, the Food and Drug Administration (FDA) has already banned red dye No. 3, which is linked to cancer. According to analysts, this marks the start of a more significant change.

Robert Moskow, an analyst at TD Cowen, told CNBC, “We think renewed consumer attention on the role of processed foods in the public health crisis is just getting started, whether justified or not.”

Moskow also cautions that there may be increased scrutiny of big food firms, which have historically prospered on convenience and inexpensive indulgence.

BellRing and Protein-Powered Brands are stocks to purchase

Analysts are beginning to like BellRing Brands, the firm that makes Premier Protein drinks. Moskow pointed out that the company’s sales are already increasing by double digits and forecasted that the popularity of obesity drugs like Ozempic and Wegovy would help it even more.

BellRing’s good performance in a market that is becoming more and more focused on health and weight management is demonstrated by its November fiscal revenue growth prediction of 12% to 16% in 2025, or $2.24 billion to $2.32 billion.

Additional investment prospects were noted by Bernstein analyst Alexia Howard, who focused on companies that address customers’ growing worries about heavy metals, plasticizers, and microplastics in food. Her favorites? The stock values of Simply Good Foods, Hain Celestial, and McCormick increased by 11% last year.

Lo & Sons Original Catalina Deluxe Premium Canvas Duffel Bag – Travel, Gym, Hospital, or Weekender Bag with Shoe Compartment for Men and Women

Divergent Customers

Customers are becoming divided into two groups, according to Rob Dongoski, a partner and global lead at Kearney’s food and agribusiness practice: those that value and are prepared to pay for healthy eating, and others who are either unable to afford it or are unconcerned with the shift toward a healthier lifestyle.

According to Dongoski, “food companies that are successful in the future carve out their niche.” “They determine whether I can serve both or if I will focus more on one than the other.”

Junk Food Remains Firm in the Mean Time

Not everybody is changing. JM Smucker CEO Mark Smucker said his company is staying true to its core business of making comfort foods like Uncrustables and Twinkies.

“Consumers will keep searching for ways to treat themselves at various times throughout the day,” Smucker said on a call with financial analysts. While they might consider lowering sugar in some products, the company is betting snacking habits won’t disappear.

Safe Picks: Food Giants with High Dividends

Food corporations that pay dividends continue to appeal to risk-averse investors. Bank of America equities strategist Savita Subramanian suggests concentrating on businesses that have “above-market and secure (not stretched) dividend yields.”

Despite shifting customer preferences, companies like General Mills, Hormel, Campbell’s Soup, PepsiCo, and Tyson Foods continue to have significant market share in the food industry.

The Decision

Although Kennedy’s campaign to “Make America Healthy Again” is still in its infancy, its effects on the food and beverage sector are already evident.

Analysts are keeping a careful eye on these reforms, and astute investors would be well advised to follow suit, regardless of whether they lead to a significant upheaval or only minor adjustments.

Will the rise of health-conscious eating overthrow indulgent snacking? Or will junk food continue to reign supreme in America’s pantries? The only certainty is that the markets—and your portfolios—are in for an interesting ride.