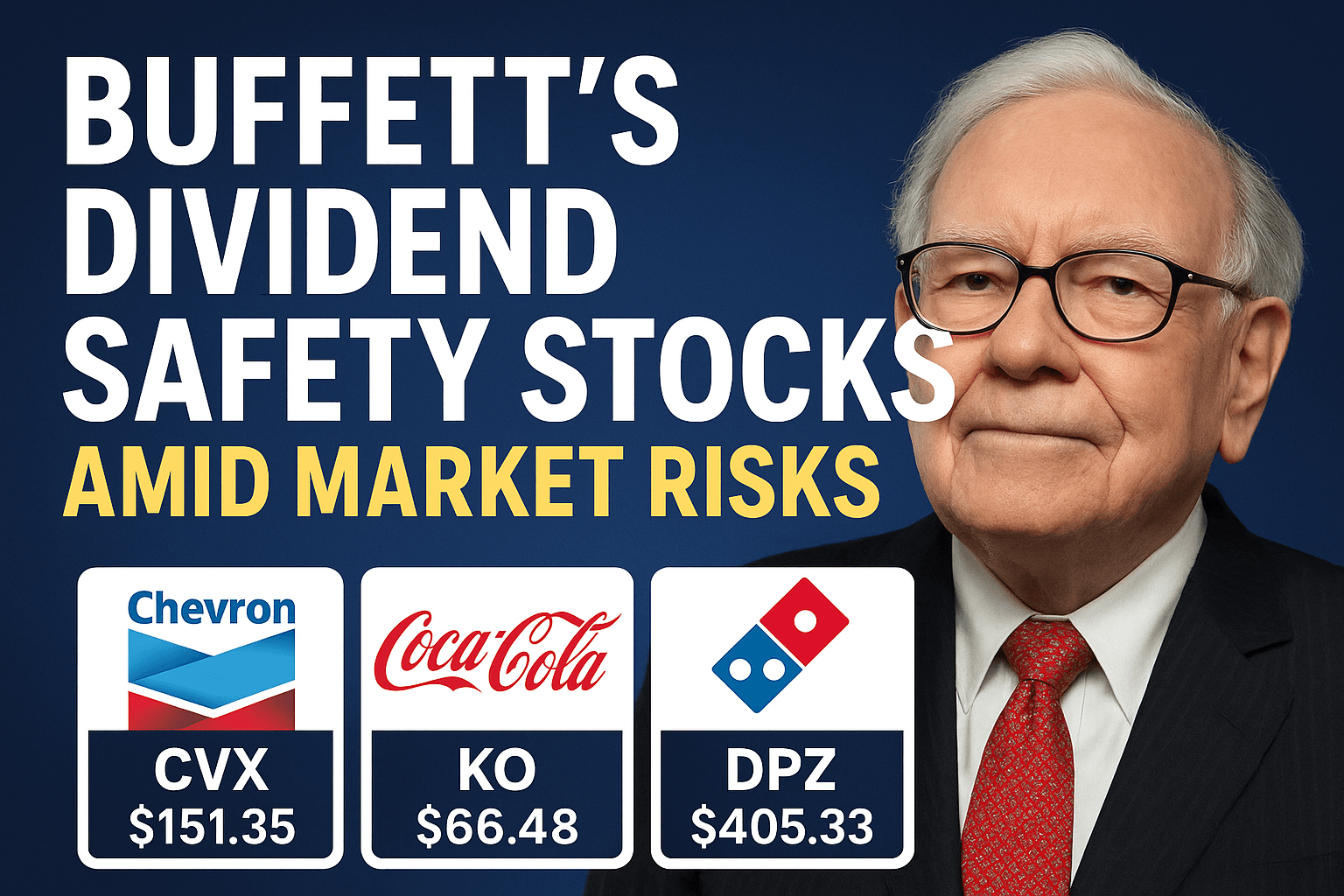

Warren Buffett’s cautious market stance highlights his top dividend safety stocks — Chevron, Coca-Cola, Domino’s Pizza, and Kroger. As fears of a 2025 market correction rise, these conservative Berkshire Hathaway holdings offer stability, strong yields, and long-term value for investors seeking safe havens.

The 10-year Treasury note, once trading at a 4.75% yield in January, has now dipped to 4.14%. Treasury yields move inversely to prices, falling as investors seek safety. While consumer spending remains solid, it is slowing, and the global trade landscape is being reshaped as tariffs rise worldwide. The United States has begun retaliating against tariffs imposed upon it, and “a host of additional factors are fanning the flames of another 2025 correction.”

Job gains have plunged, and much of the data is “perceived to be inaccurate.” Many analysts argue that “it is high time for a correction similar to the one earlier this year to help cleanse the market of the recklessness ignited by artificial intelligence almost three years ago.”

While the AI revolution is real, “countless companies that generate no revenue but make big promises are similar to the dot-com failures resting quietly in the Wall Street graveyard.”

Treatment-Resistant Depression Sees Breakthrough with Personalized Brain Stimulation

Buffett’s Cash Pile Reflects Market Caution

According to 24/7 Wall St., “after a 30% run off the lows in April, the market looks like it needs a breather.” Warren Buffett remains extremely cautious and “still has a massive $344 billion in cash, which has doubled since 2024.”

“If inflation drifts higher, investor hopes for three or four interest rate cuts over the next year seem unlikely.”

Long-time followers of Buffett know his famous quote: “His favorite holding for an S&P 500 stock is forever.” Given Berkshire Hathaway’s success and “five top companies making up almost 67% of the fund’s total holdings,” Buffett’s strategy remains concentrated but effective.

With his concerns about current market valuations and heavy cash positions, “it makes sense for investors to consider buying some of the most conservative stocks in the Berkshire Hathaway portfolio.”

Chevron: A Safe Energy Play

Chevron Corp. (NYSE: CVX) “predominantly specializes in oil and gas.” It offers “a substantial 4.31% dividend, which was raised by 5% earlier this year.” Chevron operates “integrated energy and chemicals businesses worldwide through two segments — Upstream and Downstream.”

The Upstream segment involves “exploration, development, production, and transportation of crude oil and natural gas,” along with “processing, liquefaction, transportation, and regasification associated with liquefied natural gas.”

The Downstream segment focuses on “refining crude oil into petroleum products” and “manufacturing and marketing renewable fuels.”

Chevron’s acquisition of Hess Corp. (NYSE: HES) was finalized under “an all-stock transaction valued at $53 billion,” with the deal expected to close this fall.

UBS maintains a Buy rating and assigns a $197 target price for the stock.

Coca-Cola: A Core Buffett Holding

Coca-Cola Co. (NYSE: KO) remains one of Buffett’s longest and most iconic holdings. The legendary investor owns “a massive 400 million shares that are up a solid 11% in 2025.” Coca-Cola, founded in 1892, is “the world’s largest beverage company, offering consumers more than 500 sparkling and still brands and a dependable 3.01% dividend.”

Led by its namesake brand, the company’s portfolio “features 20 billion-dollar brands,” including Diet Coke, Sprite, Fanta, Simply, Smartwater, Vitaminwater, and Powerade.

“Globally, it is the top provider of sparkling beverages, ready-to-drink coffees, juices, and juice drinks.” Consumers in “more than 200 countries enjoy the company’s beverages at a rate of over 1.9 billion servings per day.”

Coca-Cola also owns “16% of Monster Beverage Corp. (NASDAQ: MNST), which continues to deliver strong financial results.”

UBS holds a Buy rating with an $80 target price on the stock.

Domino’s Pizza: Tech-Driven Growth

Buffett added Domino’s Pizza Inc. (NASDAQ: DPZ) to his portfolio in 2024 and has “continued to add to the stake.” As of late June 2025, Berkshire Hathaway owned 2.63 million shares, representing “a 7.63% stake valued at more than $1.1 billion.”

The company pays a “1.58% dividend” and “operates a significant business in both delivery and carryout pizza.” Domino’s runs through three key segments:

- U.S. Stores: Primarily franchise operations within the United States.

- International Franchise: Global franchising operations in foreign markets.

- Supply Chain: “Distributing food, equipment, and supplies to stores” from centers in the U.S. and Canada.

Domino’s Pinpoint Delivery technology allows customers “to receive deliveries nearly anywhere — parks, baseball fields, or beaches.” With over 20,500 stores in more than 90 countries, it remains “a global pizza powerhouse.”

Loop Capital maintains a Buy rating with a $574 target price.

Kroger: A Steady Defensive Choice

Kroger Co. (NYSE: KR) is “a consistently solid and conservative investment” paying a 1.96% dividend. The retail giant operates “supermarkets, combination food and drug stores, multi-department stores, marketplace stores, and price-impact warehouses throughout the United States.”

Its grocery operations include:

- Natural food and organic sections

- Pharmacies

- Pet centers and seafood departments

- General merchandise

Meanwhile, its multi-department stores feature “apparel, electronics, toys, and home fashion,” while marketplace stores combine “full-service grocery, pharmacy, and health and beauty care.”

Kroger also “manufactures and processes food products” for its own stores and online sales and “sells fuel through 1,613 fuel centers.”

Buffett’s Conservative Edge

There are few investors “with the results and reputation that Mr. Buffett has garnered over the past 50 years.” As 24/7 Wall St. notes, while investing has evolved, “buying good companies with products and services known worldwide and paying dividends will always remain in style.”

Buffett’s latest positioning — holding cash, owning reliable dividend stocks, and avoiding market froth — “suggests a cautious but calculated strategy.” For investors navigating an uncertain market, his portfolio’s most stable names — Chevron, Coca-Cola, Domino’s Pizza, and Kroger — continue to represent “a haven of safety amid the volatility.”

Source: 24/7 Wall St