Multinationals and exporters are surging as the weak dollar divides the US stock market. Tech giants gain while domestic-focused firms struggle with higher import costs.

Multinationals and exporters are “outshining companies more geared to America’s domestic economy, as the weak dollar becomes a dividing line for the US stock market.”

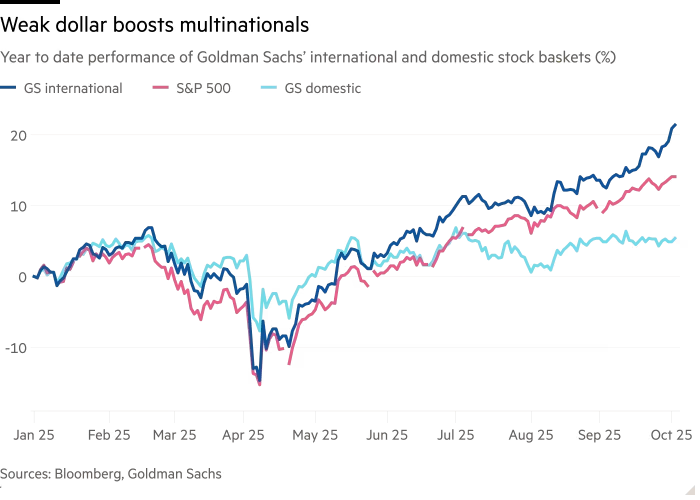

A Goldman Sachs index tracking “the 50 blue-chip US companies with the highest share of foreign sales exposure has jumped 21 per cent this year and hit a fresh high on Thursday, with stocks such as Meta Platforms, Philip Morris and Applied Materials all outperforming the S&P 500 index.”

In contrast, “the bank’s gauge of Wall Street shares with the greatest proportion of domestic sales — which includes T-Mobile US and Target — has gained just 5 per cent, as such companies failed to reap the benefit of a weaker dollar while also being hit by the steeper cost of imports.” The gap between the two indices is “the widest since 2009.”

The Dollar’s Decline

“The US currency is on course for its worst performance in a calendar year in more than two decades, dropping nearly 10 per cent against a basket of major currencies so far in 2025 as Donald Trump’s trade and economic policies cause global investors to rethink their exposure to the world’s largest economy.”

“Many have chosen to hedge their holdings of US assets by betting against the dollar, while falling interest rates have added further pressure on the currency. Wall Street analysts are predicting further losses given the Federal Reserve has signalled at least one more rate cut this year.”

“The weak dollar gives you a turbo boost,” said Steven Englander, head of global G10 FX research at Standard Chartered.

Record Stock Ownership Raises Risks as Americans Face Market Exposure

Winners and Losers

“A weaker greenback boosts a US company’s foreign earnings in dollar terms, while also making American goods cheaper abroad. Domestically focused companies do not tend to benefit, and those firms that rely on buying goods from overseas in foreign currency face higher input costs.”

“Small companies that import goods . . . will suffer and large companies with global reach and capacity to access finance will manage the impact,” said Shahab Jalinoos, head of G10 FX strategy at UBS.

“For companies selling products outside the US, it’s a windfall, particularly if they’re not importing vast amounts of product.”

Technology Giants Benefit

“The moves are proving a tailwind for some technology giants, many of which generate a significant share of their revenues overseas.”

On its second-quarter earnings call in July, “Microsoft’s chief financial officer Amy Hood said that, if exchange rates remained stable, the firm expected currency effects to increase revenue growth by ‘approximately 2 [percentage] points’ next year, according to an AlphaSense transcript.”

Englander added that “you hear about currency effects more often when the dollar strengthens and companies blame the strong dollar for losses. But management rarely says ‘we got bailed out by currency effects’.”

Outlook for Earnings Season

“The divergence will probably become more visible as third-quarter earnings season gets under way,” analysts said.

“There are a subset of companies that will benefit more than others,” said George Pearkes, a macro strategist at Bespoke Investment Group, citing “tech giants among the businesses in line for a boost from the weaker currency, and utilities and banks among domestic-facing firms that would be hurt by it.”

Some analysts suggest the pain may be limited. “If the dollar’s decline is driven by looser monetary policy, then that could end up supporting economic growth and many companies’ earnings.”

In such a case, the weak dollar “starts out where it is a bit of a concern, but then at a certain point you get to the stimulative effects of easy money”, said Scott Chronert, an equity strategist at Citi.